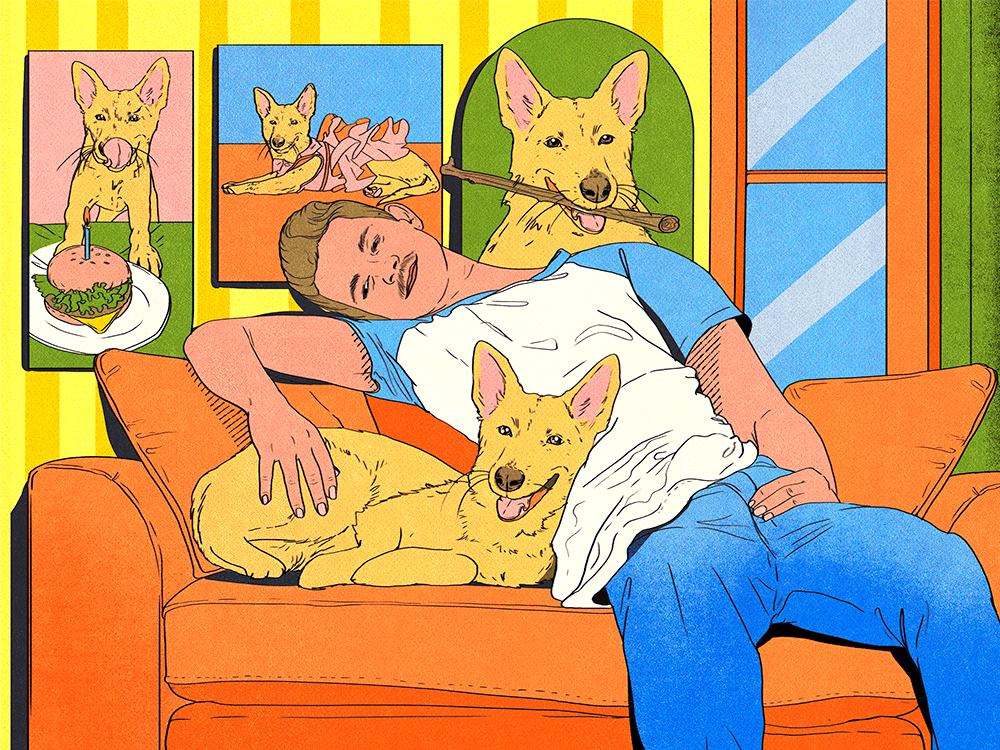

How pet parents keep their cool

Featured

Are Men Discovering Their Softer Side? New Report Finds More Males Are Adopting Cats

Man has a new best friend.

What Does Your Love Language Say About You as a Pet Parent?

We all give and receive love in our own way, pets included.

News

- lifestyle|To the Rescue

- lifestyle

- health

Got a new pet? Here’s what to do.

Let’s be real. Welcoming home a new dog or cat is a very cute but very crazy time. Thankfully, we’re here to help with a nifty new pet parent to-do list.

Get Startedopens in a new tabThe Latest

Kittens Really Need Their Moms—Science Says So

The “I’m just a baby” TikTok sound definitely applies here.

Seeing Ghosts of Their Dogs Can Help Grieving Pet Parents, New Study Says

People welcome paranormal activity if their pets are involved.

Most Popular

- health

- behavior

- lifestyle

- shopping

- lifestyle|Heavy Petting

- behavior

Ask a Vet

Pet health question that’s not an emergency? Our vet team will answer over email within 48 hours. So, go ahead, ask us about weird poop, bad breath, and everything in between.

Health & Nutrition

Can Dogs Get Pimples? Causes, Symptoms, and Treatments

Time to go to the doggie dermatologist!

Time to go to the doggie dermatologist!

5 Plants That Are Toxic to Your Dog

Thriving plants are spring’s whole thing—but these offenders can be perilous to pets.

Thriving plants are spring’s whole thing—but these offenders can be perilous to pets.

Behavior & Training

Why You Shouldn’t Be Skeptical of Positive Training Methods

It is powerful enough, even for the tough cases, and it is the best choice—here’s why.

It is powerful enough, even for the tough cases, and it is the best choice—here’s why.

Yes, It’s True: Study Says Cats Love People Who Don’t Like Cats

It’s not all in your head.

It’s not all in your head.

Get your fix of The Wildest

We promise not to send you garbage that turns your inbox into a litter box. Just our latest tips and support for your pet.

Lifestyle

8 Dog Hiking Services That’ll Take Your Pup on a Nature Adventure For You

Most dogs can benefit from taking a walk on the wild side.

Your Comprehensive Guide to Eco-Labels on Pet Products

Here are the sustainability buzzwords you should look out for on the packages of your fave products.

Here are the sustainability buzzwords you should look out for on the packages of your fave products.

BARK Air Is a New Dog-Friendly Airline—But the Prices Are Sky High

Your dog will get their own puppy concierge to make sure all their in-flight needs are met.

Your dog will get their own puppy concierge to make sure all their in-flight needs are met.

Shopping

11 Eco-Friendly Pet Grooming Products

Package-free brushes, plant-based wipes, certified-organic shampoos, and more.

What Are the Best Dog Nail Clippers?

Finally—you won’t dread at-home grooming time.

Finally—you won’t dread at-home grooming time.

Animal Welfare

Congress Orders the Department of Veteran Affairs to Stop Testing on Cats and Dogs

Under new legislation, all experiments on dogs, cats, and primates must end by 2026.

Why Kitten Season Is Getting Longer and More Intense Every Year

And what you can do to help.

Los Angeles Bans New Breeding Permits Due to Shelter Overcrowding

Local lawmakers think breeding has gotten out of control.

New Dog Training 101

Look, new dogs are cute. But they’re also little alien monsters who have descended to destroy our furniture and our sleep. Still, we love them. Luckily, this program covers all the basics, from potty training to proper socialization—all through positive reinforcement. Time to stock up on treats!

Start Trainingopens in a new tab

Our editors and experts created the ultimate guide to the best products in pet care. Check out the winners—and snag some discounts too.